Execution Types

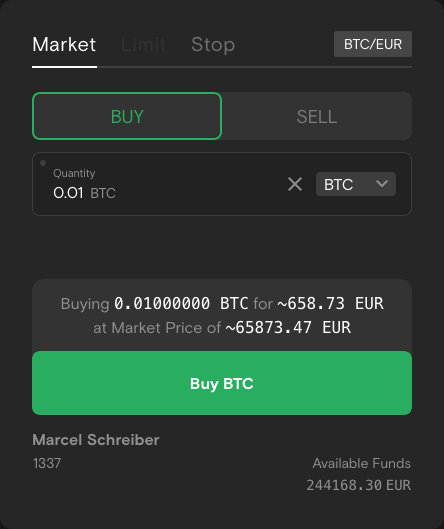

Market

A market execution is a standard instruction to buy or sell a base asset — the first asset in a symbol — at the current market price. When placing this type of execution, you specify either the quantity of the base asset or the quantity of the quote asset you wish to trade. While this type guarantees the execution will be filled, the final price may differ slightly from the quoted price due to market fluctuations.

Once placed, market executions are listed under “Active Executions.” After completion, whether successful or not, they are recorded in the execution history. Trever distinguishes between two variations of market executions: Market - Amount, where the quantity of the base asset is specified, and Market - Volume, where the quantity of the quote asset is specified. It is important to note that not all exchanges support the Market - Volume order type.

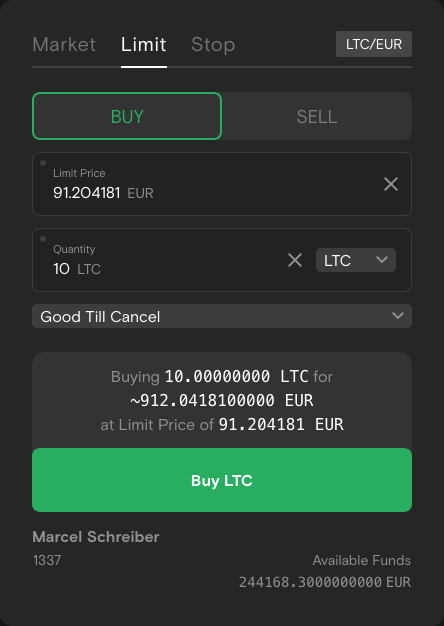

Limit

A limit execution allows users to set a specific price at which they are willing to buy or sell a base asset. If you’re looking to buy, the limit price should be set below the current market price, while for selling, it should be set above the market price. The execution will only execute if the market price reaches or surpasses the specified limit price.

Additionally, you have the option to set the execution validity using parameters like “Good Till Cancel,” “Good Till Date,” or “Immediate or Cancel,” offering flexibility in executing. E.g., you can place a limit execution to buy a certain quantity of an asset if the price drops to a specified level before a given date.

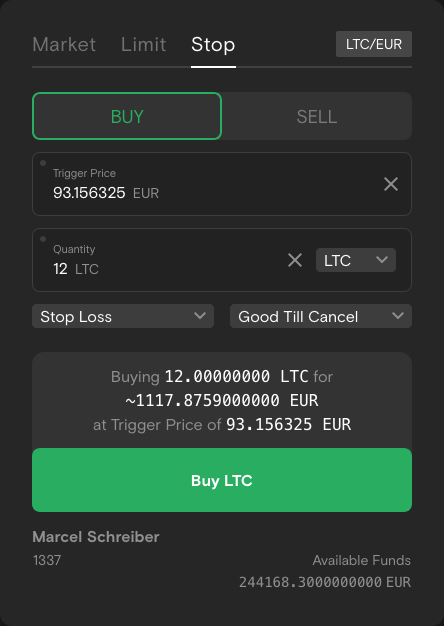

Stop

Stop execution, including stop-loss and take-profit execution, are designed to trigger market executions once a predetermined price level is reached. A “Take Profit” execution is placed with a trigger price above the current market price, while a “Stop Loss” execution is placed with a trigger price below the current market price. These executions can be set to expire using options such as “Good Till Cancel” or “Good Till Date.” In Trever Trading, stop execution can also be utilized for buying assets, allowing you to enter a position once the price breaks through a significant resistance level, indicating a potential upward trend.

Conclusion

It’s essential to understand these execution types thoroughly and consider your trading strategy and risk tolerance before placing execution on Trever Trading. If you have any questions or need further clarification, please don’t hesitate to reach out to our support team.